By Riaan Bekker, Force Solutions Manager, thryve Knowledge is power, and today the leading way to derive knowledge is through data analytics. Now, you may say: but we’ve been getting along just fine without data analytics of this sort, so why start now? That’s true, yet think of it in another way. Companies also […]

thryve’s family of cloud-based medium and large enterprise risk, finance and customer management services migrate to Microsoft’s market-leading hyperscalar presence. thryve, a leading provider of cloud-based risk, customer and financial-managed solutions, has successfully completed its migration to Microsoft’s Azure hyperscale cloud datacentres. thryve is a pioneer of cloud-powered platforms that help our customers accelerate […]

Clients of thryve’s Riskonnect solutions can now enjoy access to LexisNexis’ African compliance and policy content. thryve is proud to announce the addition of LexisNexis compliance and policy content, integrated into our Riskonnect solution. For over a decade, thryve has been providing the best GRC management tools to large and medium enterprises, including companies […]

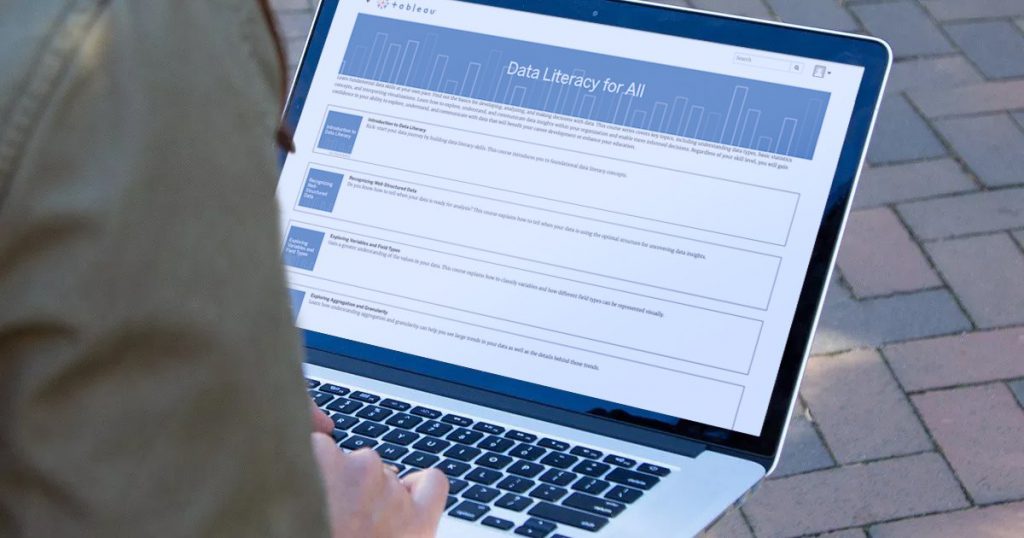

It’s time to kill the open office. It’s also time to gain some data literacy – for free! And while we’re on the topic, the time is ripe to introduce integrated risk management practices, and also tweak how sales work in a world where phone calls are replacing in-person interactions. Our monthly selection of […]

By Sean Pyott, MD of thryve Last month, I reflected on the importance of risk managers and why they are in high demand right now. But what about companies – what kind of changes should they undergo to make better use of new risk management practices? It’s an important question because modern risk-management practices […]

By Neer Rama, Force Solutions Product Manager at thryve Canada Smaller is often better, especially when you don’t want to be a target. But as technology levels the playing fields, giving medium-sized businesses the capability to play in bigger leagues, it’s also started to erase that anonymity. Smaller companies are wising up to the […]

By Riaan Bekker, Force Solutions Manager at thryve It’s not true that risk management is only for large, stock exchange listed, enterprises. Any businessperson would agree with this statement. Running a business is inherently risky. Costs, margins, stock, staff and assets all require some consideration to keep them safe and productive. Locking your […]

By Sean Pyott, MD of thryve People have been predicting for years that risk management will step from its back-office nook and into the leadership sphere. This prediction gained some traction at the start of this century with integrated risk management (IRM) and Governance, Regulation & Compliance (GRC) technology systems offering greater integration […]

By Riaan Bekker, Force Solutions Manager at thryve Small to medium businesses don’t focus on risk as much as their enterprise peers. Many enterprises are public companies and therefore must follow many more compliances and regulations. Such mandated functions are often draining on time, people hours and money, so enterprises want efficient GRC […]

How are financial services companies faring during the pandemic? Are small and medium businesses getting back to their previous operating levels? What can banks do to help their customers avoid defaulting on home loans? And is the pandemic a significant opportunity for insurers – if they can modernise? The answers are in the […]