Ledgers and lists have always been a part of businesses. The ancient Phoenicians invented the modern alphabet in order to manage their business transactions. Even civilisations that relied on word of mouth still devised complex systems to record and track assets, such as the intricately knotted strings used by South American Incas.

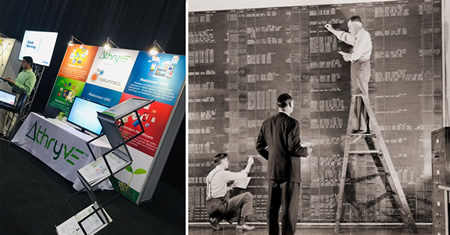

This practice became electronic in the early Eighties when the first spreadsheets arrived – and they changed the world. Today it is a matter of pride and precision to wield a spreadsheet’s full potential, augmented with powerful tools such as pivot tables. In fact, over a billion people are said to use Excel spreadsheets and this humble format can be found at every level of a company, not to mention in our personal lives as well!

Spreadsheets are particularly useful for risk-related analysis. Information is tallied and shared across different departments, fed through formulas and weighed to get the best result. The spreadsheet has grown from its humble start 35 years ago into a fulcrum of great business practices.

Alas, every great tool has its limits and we are increasingly seeing the spreadsheet at its wit’s end. Even though they are very useful for initial listings of risks in an organisation, they can’t keep up with the demands of the general process.

Think about it: how often do risk managers sit and work out the conflicts between spreadsheets supplied from different sources? Spreadsheets are still contextual and susceptible to human error. When it comes to bringing everything together in one meaningful truth, spreadsheets actually demand plenty, yet often still don’t deliver a conclusive answer.

But that is not the end of good risk management – nor of the spreadsheet. If a business uses a risk data integration platform such as Riskonnect, it is able to have the best of both worlds. Disparate spreadsheets can be imported into the platform by their respective creators, which is balanced to take their individual ratings in mind. That same platform can also draw on other data sources, balancing everything to present one coherent view of a company’s risk-and-response landscape.

Getting this started isn’t even a massive leap. By using the power of cloud and data integration, anything from spreadsheets to incumbent business systems can be made part of the process. Best of all, it’s not solely on the risk managers – all parts of the business can participate. This frees up valuable time, speeding up processes to consider risk solutions and cuts through mountains of conflicting paperwork!